Community Forward Redlands Named 2025 New Organization of the Year

The honor, voted on by the community, was presented by the Redlands Chamber of Commerce on Jan. 31, 2026.

After four years of steady price increases, Redlands’ housing market may be shifting. New September data from Realtor.com shows inventory climbing rapidly while median listing prices dip for the first time since early 2024.

Last week, Realtor.com released its monthly zip code-level update of the real estate market for September 2025. Here’s how the local housing market is changing this fall.

For the Redlands zip codes of 92373 and 92374, the data told much of the same story as in recent months: high median listing prices and slow-moving inventory. Inventory movement is measured by the median number of days that listings were on the market that month, which clocked in at 58 in 92373 and 65 in 92374.

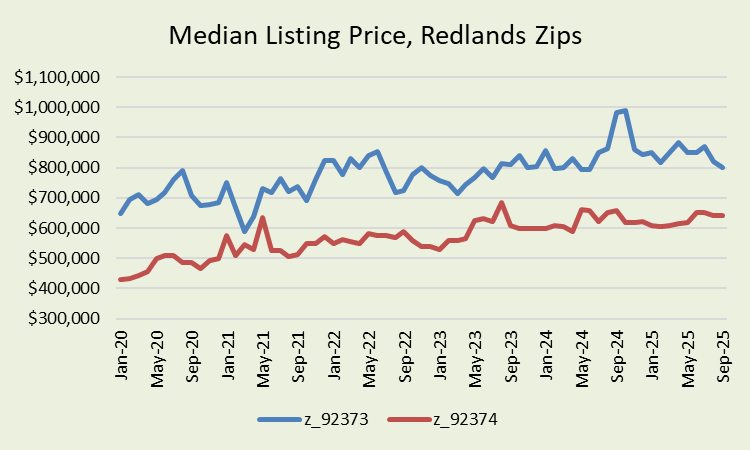

Median listing prices were just shy of $800,000 in 92373 and $641,000 in 92374.

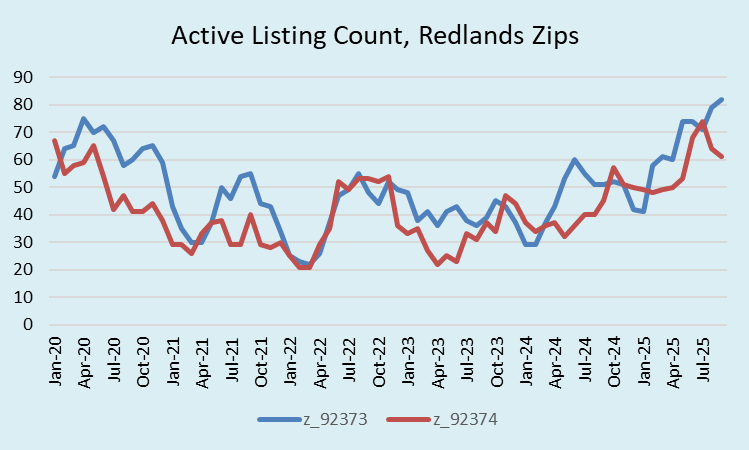

Regionally, the big news is the spike in inventory, which Realtor.com measures by counting the number of active listings in a given month. Since early 2024, inventory has climbed in 92373 and 92374 at an astonishing pace.

Higher inventory is supposed to mean more options for buyers, competition among sellers, and lower prices. Until recently, prices have remained stubbornly high. That may be starting to change. In September 2025, median listing prices in 92373 dipped below $800,000 for the first time since January 2024 and were down almost 20% year-over-year. It’s the first sign of stabilization after four years of consistent price increases since the pandemic.

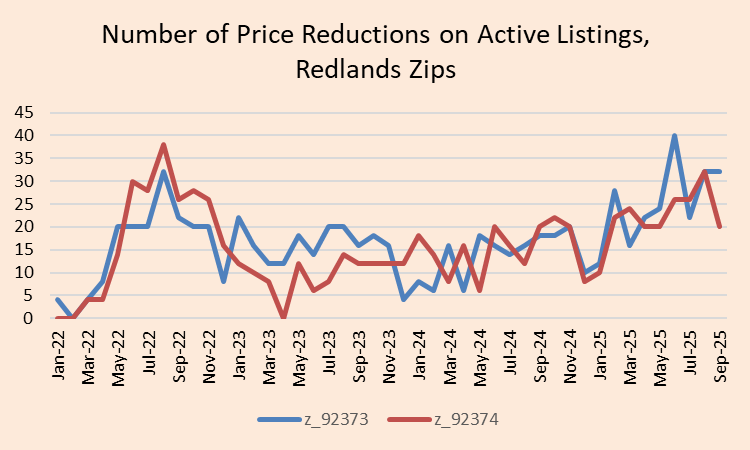

Further evidence of downward price pressures comes from the number of price reductions on active listings, which Realtor.com counted at 32 in 92373 and at 20 in 92374 - metrics that have gradually increased since early-2024.

There may be relief on the way, but it is not clear how much. Since the end of May, average 30-year mortgage rates across the U.S. have trended downward from close to 7% to 6.3%. The Fed's promise to cut rates in its meetings later this year, in addition to the cut on September 17, may provide a boost to home sales, which are frozen at the lowest levels in the last three decades. The 30-year mortgage rate does not always follow Fed cuts, so there is still uncertainty about whether the housing market can recover, since everyone agrees that can only happen with an interest rate cut.

For now, Redlands buyers still have the upper hand.

Daniel MacDonald is an economics professor at California State University San Bernardino. He teaches about regional data sources and the political economy of Southern California. Find more of his writing on Substack @dpmacdonald

Sign up for our weekly newsletter